Investments and the ESG factor

Improving data protection

No company can afford to stop investing, especially in technical updates. In 2022 Camst was the victim of a hacker attack, which highlighted the need to upgrade the protection of the company’s assets.

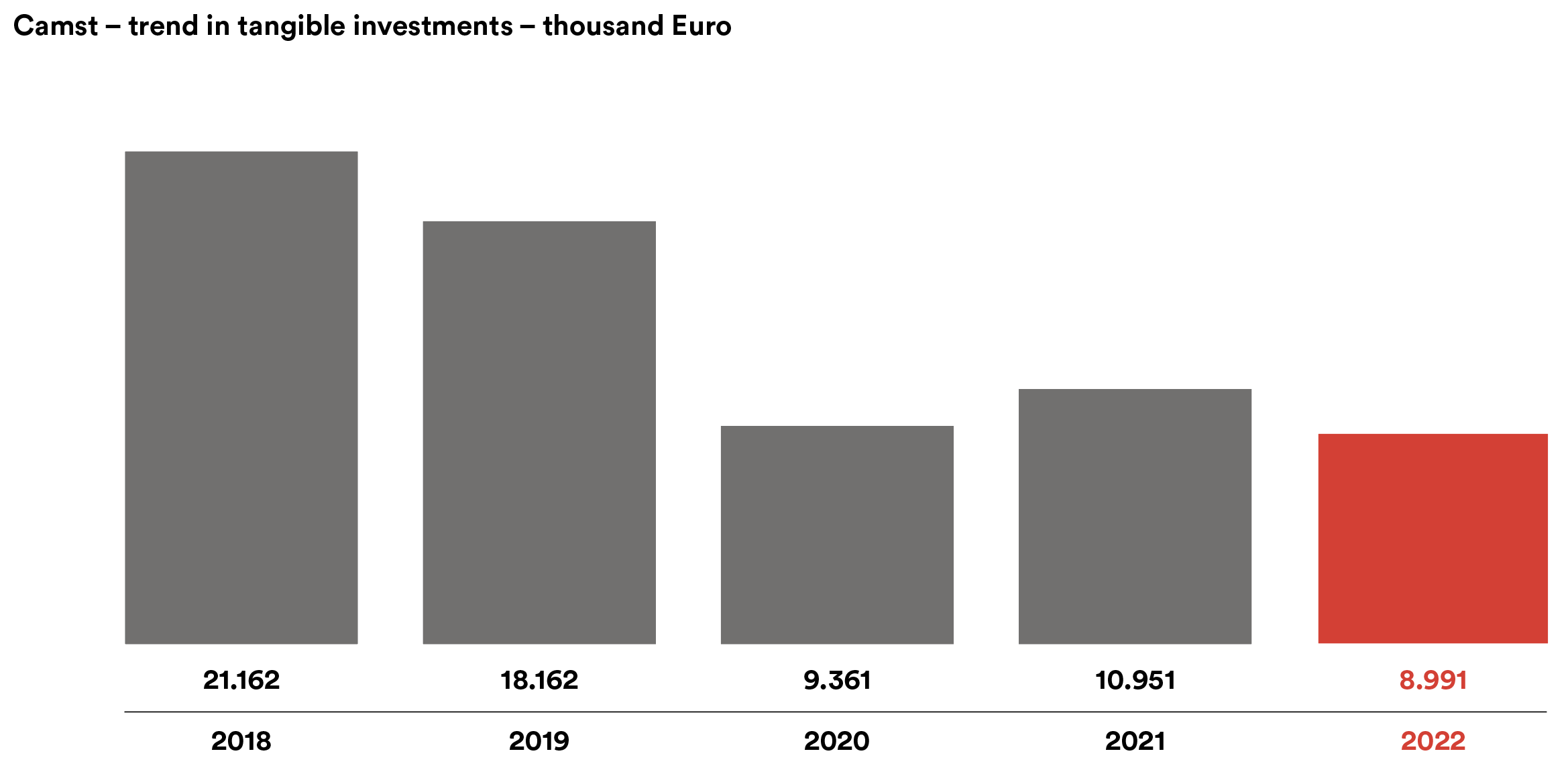

The Camst group’s technical investments in 2022 totalled € 142 million, of which € 9 million were allocated to new projects. In spite of the after-effects of the pandemic and the increase in energy and raw material prices, investments in commercial catering were restarted during the year. Allocations were also made for data protection, the need for which became even more urgent after the hacker attack which occurred in November.